Carbon Border Adjustment Mechanism (CBAM) coming into place

How the carbon leakage can affect countries environmental policies and the companies’ business activities?

What is the CBAM and which challenges aims to solve? In this article SuFu wants to explain all the causes and consequences that led the EU proposing the CBAM as a tool to mitigate the risks of carbon leakage within EU borders.

What is the problem?

The ultimate objective of the European Green Deal is to achieve climate neutrality, while favouring the transition from industrial carbonization to decarbonization. Proceeding towards this goal, various and successful measures have been implemented so far: measuring and reducing companies GHG’s emissions as one of them.

While some Countries strive to reduce their impact on climate change, there are valid concerns that imposing stricter pollution regulations may spark the migration of businesses to other Countries with less strict policies. The additional emissions originated due to such relocation is termed as carbon leakage. This refers to a situation where policies implemented to reduce carbon emissions in one place inadvertently trigger an increase in GHG emissions elsewhere. This phenomenon, a type of spill-over effect can arise due to a variety of factors, including: • production shift

• production costs increase

• imports

• export loss

• deforestation

What is the solution?

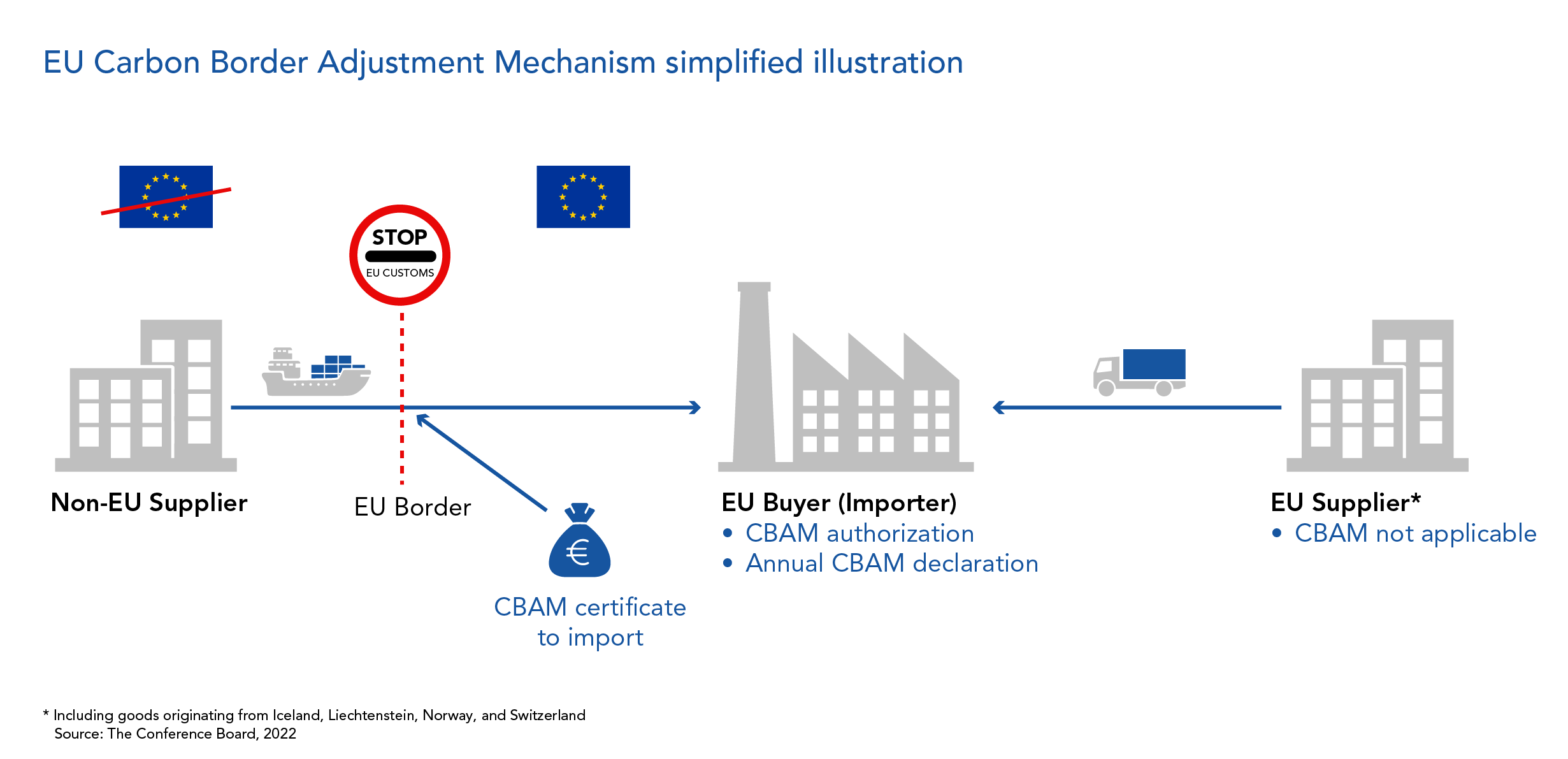

While the existing EU Emissions Trading System (ETS) covers EU countries, the Carbon Border Adjustment Mechanism (CBAM) will apply to goods imported into the EU.

The CBAM is the EU's tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, ultimately encouraging cleaner industrial production in non-EU countries.

Further, it ensures that the carbon price of imports is equivalent to the carbon price of domestic production which guarantees that the EU's climate objectives are not undermined.

How does the mechanism work?

The CBAM, in force since 1st October 2023, will be implemented in two phases:

Transitional Phase (October 2023 – December 2025)

Importers of products of six carbon intensive sectors will need to report quarterly their emissions. The initial products are aluminium, cement, electricity, fertilisers, hydrogen, iron and steel.

While this Transitional Phase comes without financial obligations (no need to buy and surrender certificates) and simplified reporting rules, its primarly focus is on collecting data.

The CBAM report must include:

the total quantity of each type of goods imported into EU

the actual total embedded emissions

the total indirect emissions

the carbon price due in a country of origin for the embedded emissions in the imported goods.

2. Definitive regime (from 1st of January 2026)

From this date, EU importers will need to:

obtain an authorization to import CBAM goods

declare the quantity of CBAM goods imported into the EU in the preceding year

declare their embedded GHG emissions

surrender the corresponding number of certificates each year to cover the declared emissions. The price of the certificates will be calculated depending on the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted

In other words, importers will begin to pay a border carbon tax for their products imported, and their embedded emissions based on the price of allowances in the EU ETS.

Failure to comply with CBAM reporting requirements, inaccuracies in CBAM reports or purchases of too few certificates can result in penalties. The financial sanctions are set by each EU member state, ranging from €10 to €50 per CO2 ton.

What will companies need to do?

Although the CBAM will not be implemented in full until 1st January 2026, companies need to gather the necessary data for the reporting. This preparation can apply different steps, for example by:

Conducting a scenario analysis to identify emissions related to CBAM-applicable imported goods and conducting an initial impact assessment (which products will be covered by the CBAM? Where do these come from and what is the volume of the company imports of such products are some of the questions will be evaluated)

Quantifying the financial risk of CBAM and the impact of importations, which means being able to assess benefits and costs of production locations.

Engaging with suppliers and rest of the supply chain to gather emissions data for imported goods

Setting up the process to collect data on production sites and underlying emissions

Setting up the reporting process in the EU according to CBAM’s regulations and preparing to submit the CBAM reports

Regarding where to report, the European Commission has developed the CBAM Transitional Registry to help importers perform and report as part of their CBAM obligations.

In this initial step, there will be space for a lot of cooperation between companies and suppliers. For instance, suppliers delivering raw materials or goods to the EU will need to provide emissions data or carbon footprints on products. Importers will need to quantify the financial risk of CBAM and the impact of importation, which means being able to assess benefits and costs of production locations. They will also need to consider the advantages and disadvantages of choosing low emitting suppliers outside of the EU or relocating back the manufacturing within the EU.

How can SuFu assist you?

If you need support navigating the risks and opportunities surrounding CBAM, SuFu can help you by providing guidance on:

Collecting data for your Carbon Footprint/GHG emissions

SuFu can provide such services for individual products and wider value chains, measuring and reporting the emissions of products being imported into the EU. Our team has expertise developing footprinting models for products and services, which can be aligned to CBAM requirements and each business’ needs.

Verification of Carbon Accounting

As product footprints will need to be verified for CBAM, we also provide verification services.

Supplier Engagement

We can support enterprises engaging with suppliers on reducing their product footprints. Measuring your carbon footprint will help you and your suppliers to holistically understand where the hotspots emissions are and therefore where to reduce.

Climate-related risks and opportunities assessments

Our experts can provide analysis of the risks and opportunities of CBAM to business operations, as well as their probability. They can also evaluate the overall financial impact of CBAM on companies revenues and help you gain strategic foresight and operational value in your decarbonisation journey.

In conclusion, the CBAM is designed to fight carbon leakage and ensure a more responsible competition. It will make cheap carbon intensive imports less attractive than cleaner products made in EU, by charging companies that import polluting goods from non-EU countries. The CBAM is also supposed to encourage responsible behaviour by stopping companies moving the production abroad, therefore reaching the EU’s climate goals.

Sources:

European Commission. (n.d.) Carbon Border Adjustment Mechanism.

Retrieved from https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_enEuropean Commission. (2023). Carbon Border Adjustment Mechanism.

Retrieved from https://trade.ec.europa.eu/access-to-markets/en/news/carbon-border-adjustment-mechanism-cbamFFE. (2023). Carbon Border Adjustment Mechanism (CBAM) is in force. What needs to be considered.

Retrieved from https://www.ffe.de/en/publications/carbon-border-adjustment-mechanism-cbam-is-in-force-what-needs-to-be-considered/Terrascope. (2023). A Guide to Understanding the Carbon Border Adjustment Mechanism.

Retrieved from https://www.terrascope.com/blog/cbam-a-guide-to-understanding-the-cross-border-adjustment-mechanismDentons. (2024). The EU Carbon Border Adjustment Mechanism (CBAM) applies now.

Retrieved from https://www.dentons.com/en/insights/articles/2024/february/21/the-eu-carbon-border-adjustment-mechanism-cbam-applies-nowGlobal Compliance (2024). European Union: The new European Carbon Border Adjustment Mechanism.

Retrieved from https://www.globalcompliancenews.com/2024/02/02/https-insightplus-bakermckenzie-com-bm-energy-mining-infrastructure_1-european-union-the-new-european-carbon-border-adjustment-mechanism_01162024/